2023 Banking Crisis: Old World vs New World

The recent banking meltdown exposed the dysfunction of centralized, trust-based systems. Bitcoin and Web3 are an antithesis to that. Here's what's going on.

“The root problem with conventional currency is all the trust that’s required to make it work. Banks must be trusted to hold our money and transfer it electronically, but they lend it out in waves of credit bubbles with barely a fraction in reserve.”

– Satoshi Nakamoto

Yesterday, just after the news that Credit Suisse will be swallowed by UBS, the markets rejoiced.

“Aren’t markets closed on weekends?” No! It’s crypto, stupid! In a realm where trust was frayed, and the old guard held sway, crypto rejoiced, Bitcoin rejoiced!

Enough. Serious times deserve serious thoughts.

Given the current macro conditions, I’ll take the freedom zoom out for a second from Web3 and brands. I think it’s important to get the macro context right, as it helps to understand Web3 too. If you missed my previous crypto pieces, here they are:

So, what’s happening?

(Spoiler: I included a lot of footnotes. It’s worth checking them out.)

Centralization of power

“Those who would give up essential liberty to purchase a little temporary safety deserve neither liberty nor safety.” – Benjamin Franklin

After the biggest financial crisis since 1929 in 2008, after UBS had been bailed out by the state with tax money, after almost 15 years of quantitative easing (aka free money)1, after a new wave of financial regulation and supervision (cf. Basel III2), after years of zero or negative interest rates that led to record high debt levels, record high inflation, zombie companies who financed themselves with cheap debt, record high gains for investors and the financial elite while the middle class has suffered from inflation3, the old financial system is again dysfunctional and on the brink of a collapse. Silvergate, Silicon Valley Bank, Signature. And now Credit Suisse.

This is historic.

Fyi: Credit Suisse was founded in 1856 by Alfred Escher as Schweizerische Kreditanstalt and is (or was) and played a crucial role in the development of the Swiss economy. It was also among the 30 global systemically important banks.

So, what happened?

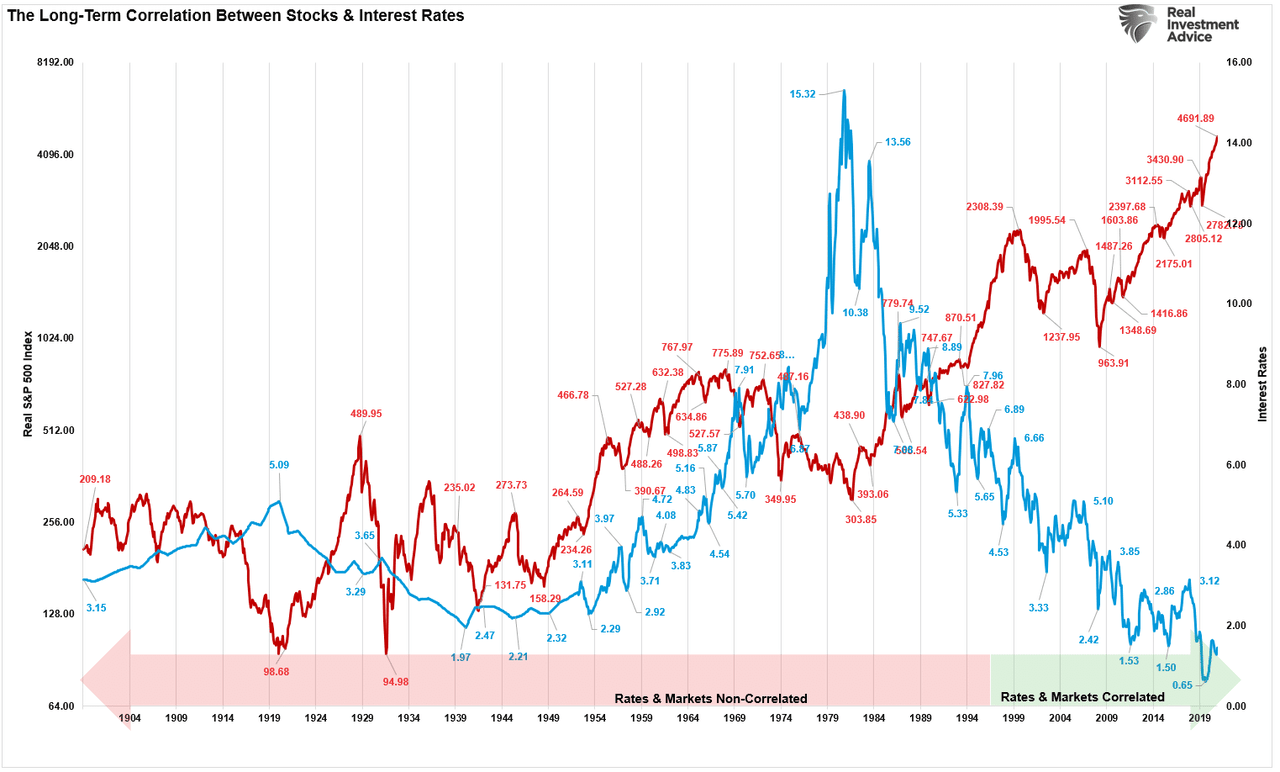

In short: Silvergate couldn’t handle asset outflows after it had been hit by the FTX scandal. Silicon Valley Bank bought too many long term treasuries that got substantially devalued with rising rates.4 Together with asset outflows and improper public comms, it fell victim to a bank run. Credit Suisse experienced a loss of trust and the risk of a bank run after years of scandals, mismanagement and miscommunication.5

All those banks were regulated, audited and followed the major accounting standards.

What went wrong?

Exogenous factors: Quantitative easing, Covid stimulus, inflation, inflated asset prices, overleverage, rising interest rates to tame inflation, fragility, increased volatility. All originating from central banks’ policy decisions.

Endogenous factors: Failed risk management, failed communication, loss of trust, bank run.

Catalyst: The media. Social networks. Speculators.

The saviour: The US and Swiss governments. What should they do? Let them fail and risk an economic collapse? Or step in with short-term liquidity and thereby promote even more risk taking in the future?

Meanwhile, the “bigger” banks are buying them up (Bank of America is said to buy Signature bank; UBS is buying Credit Suisse) – and become even bigger, and more “systemic” as a result. The assets of UBS/CS combined are now more than 2x the size of Swiss GDP.

The result?

More centralization

Higher dependence on governments

More risk

A more fragile system

No accountability

Likely more regulation

Likely more inequality

Isn’t there something wrong here? Isn’t that a f** freak-show?

Fragility, Complexity, Volatility

The dilemma of modern times: Reducing risk in the short-term vs. increasing risk in the long-term. The nature of our political systems, election and news cycles, frequency of crisis, craving for novelty result in a natural bias for the short-term.

In fact, volatility has become more polarised, leading to lower periods of low volatility and a fatter tail of very high volatility.

Nassim Taleb called this “sailing too close to the wind”:

“Black Swan effects are necessarily increasing, as a result of complexity, interdependence between parts, globalization, and the beastly thing called “efficiency” that makes people now sail too close to the wind.

It seems as that the financial system, the markets, the institutions have become more dependent on trust, more dependent on central banks, more fragile.6

We find ourselves in truly unparalleled times.

Meanwhile, with new regulation and centralization, the financial system has become more complex.

A corollary to the preceding point is that complex systems run as broken systems. The system continues to function because it contains so many redundancies and because people can make it function, despite the presence of many flaws. […] The potential for catastrophic outcome is a hallmark of complex systems. It is impossible to eliminate the potential for such catastrophic failure; the potential for such failure is always present by the system’s own nature.

– Richard I. Cook, MD, Cognitive Technologies Labratory, University of Chicago

A lot of what happened in recent months in traditional finance and in crypto (cf. FTX, 3AC, Celsius) goes back to failures of systems based on centralized trust and human inviolability.

And increased centralized intervention won’t help. Risk cannot be destroyed, it can only be shifted through time and redistributed in form.

Christopher notes:

Global Capitalism is trapped in its own Prisoner's Dilemma; forty four years after the end of the Bretton Woods System global central banks have manipulated the cost of risk in a competition of devaluation leading to a dangerous build up in debt and leverage, lower risk premiums, income disparity, and greater probability of tail events on both sides of the return distribution. Truth is being suppressed by the tools of money. Market behavior has now fully adapted to the expectation of pre-emptive central bank action to crisis creating a dangerous self-reflexivity and moral hazard.

He adds:

Central banks have taken asset returns from the future and brought them to the present... they have taken tail risk from the present and shifted it into the future...

Where do we go from here?

What about… the scam money, called Bitcoin?

Here comes a technology that tries to replace these failed, centralized foundations of trust with something trustless, decentralized, and independent.

Maybe – just maybe – it is worth a thought?

Decentralization of power

Let’s go back in time for a minute. I’ll try to keep it short and sweet.

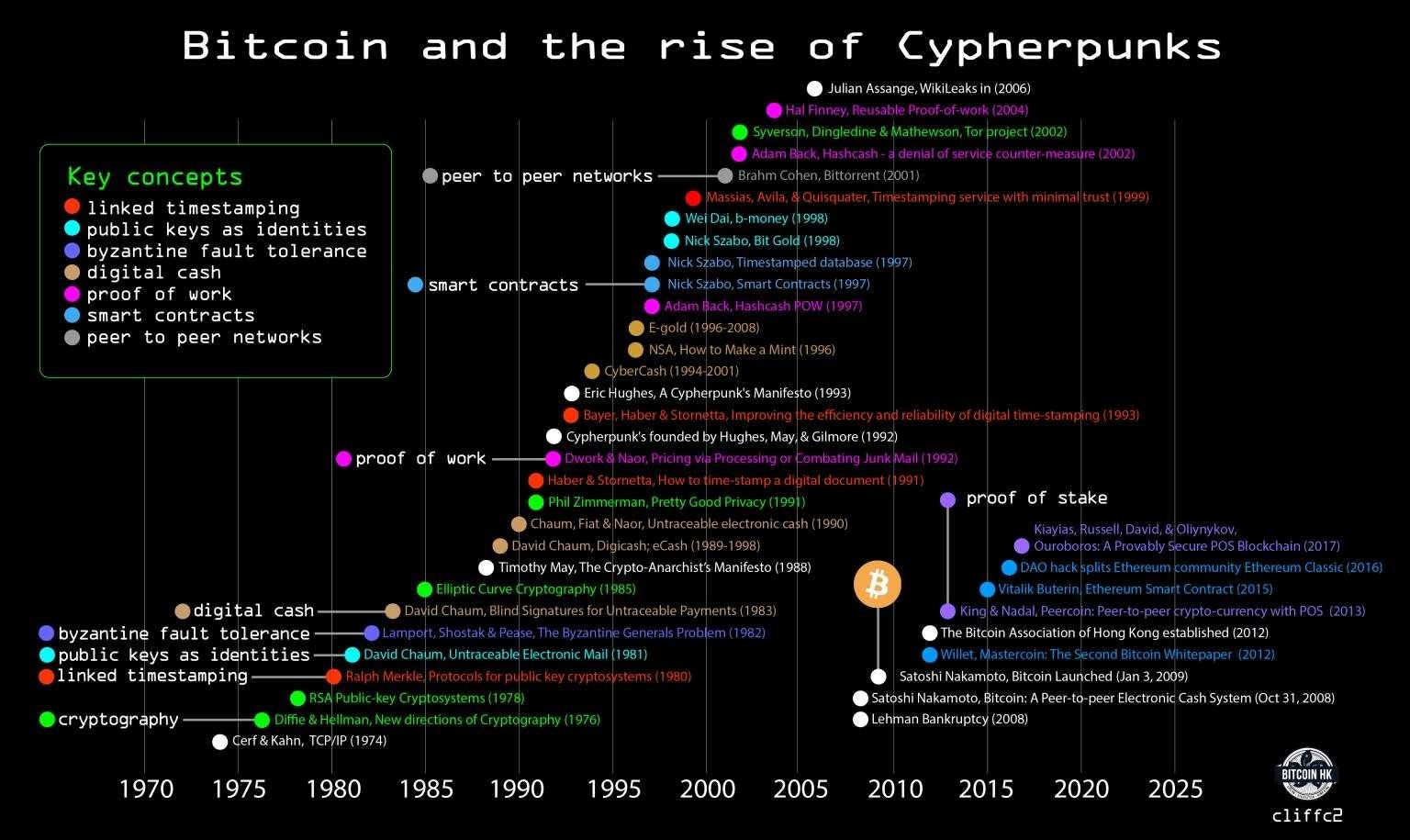

The idea of a private, state-independent currency originated from the early innings of the “Cypherpunk” movement. Cypherpunk refers to a group of people in the late 1980s and 1990s, who recognized the necessity to protect people's privacy online by using cryptography.

Rooted in cypherpunk history, Bitcoin community was formed around the principles of freedom, transparency, decentralization, and privacy – all of which the current financial system seems unable to provide.7

“The root problem with conventional currency is all the trust that’s required to make it work. The central bank must be trusted not to debase the currency, but the history of fiat currencies is full of breaches of that trust. Banks must be trusted to hold our money and transfer it electronically, but they lend it out in waves of credit bubbles with barely a fraction in reserve. We have to trust them with our privacy, trust them not to let identity thieves drain our accounts.”

– Satoshi Nakamoto

At its core, Bitcoin as a concept is a movement towards open, decentralized finance. By making units of value – stocks, bonds, real estate, currencies, etc. – interoperable, programmable, and composable on open ledgers, capital markets will become more accessible and efficient.

Others see as global, state-free money. Or an inflation hedge. Or as a long-term bet against the collapse of the FIAT monetary system. That’s secondary.

How’s that connected to… Web3?

What Bitcoin is to the financial system, Web3 is to the internet.

There is increasing mistrust in concentrated power. Whether it is government, central banks, or global omegatech corporations that have become more powerful than nations. The trend of deplatforming, behavioural mandates and censorship has created new interest in building trustless and censorship-resistant platforms that can empower ordinary people and fractionate existing power structures.

The trend of platform monopolies that control the modern internet and own their users’ data, such as Facebook, Twitter, Instagram, Google and others, has created new interest in building trustless and censorship-resistant systems that can empower ordinary people and distribute existing power structures.

Web3 was designed to fix the two biggest issues of the internet today: privacy and monetization.

Joe Lubin, co-founder of Ethereum, once said:

“We are building a new organising principle for the planet and a new foundation of trust. Don’t you think it would be a good thing for humanity?”

So, whenever we speak about Web3, NFTs, and all those wonderful possibilities this technology enables, we should never forget its roots.

There’s a reason why decentralization is so central to the ethos and the technological foundations of Bitcoin and Web3.

Back to building.

– Marc

Further reading:

Buterin, V. (2017, February 6). The meaning of decentralization. Medium. Retrieved March 20, 2023, from https://medium.com/@VitalikButerin/the-meaning-of-decentralization-a0c92b76a274

Christopher, C. (2015, October). Volatility and the Allegory of the Prisoner’s Dilemma. Retrieved March 20, 2023, from http://csinvesting.org/wp-content/uploads/2015/10/Artemis-Q32015-Volatility-and-Prisoners-Dilemma.pdf

Cook, R. (n.d.). How complex systems fail. How Complex Systems Fail. Retrieved March 20, 2023, from https://how.complexsystems.fail/

Zhang, C., Enrich, D., Russell, K., & Koeze, E. (2023, March 18). Why people are worried about banks. The New York Times. Retrieved March 19, 2023, from https://www.nytimes.com/interactive/2023/03/18/business/why-people-are-worried-about-banks.html

In times of low inflation or economic downturn, central banks use quantitative easing (QE) to stimulate economic growth.

Through QE, central banks purchase large quantities of government bonds and other financial assets from the open market, injecting money into the economy and increasing the supply of money. This process helps lower long-term interest rates, encourages lending by financial institutions, and promotes consumer and business spending.

QE is an unconventional monetary policy tool with potential risks and uncertainties. One of the concerns surrounding QE is the potential impact when central banks decide to unwind their asset purchases and raise interest rates. The process of reversing QE, or "quantitative tightening," may lead to higher borrowing costs and reduce liquidity in financial markets, posing challenges for the economy. Additionally, there is limited historical precedent for unwinding such large-scale asset purchases,

Basel III is a comprehensive set of financial regulations developed by the Basel Committee on Banking Supervision (BCBS) in response to the Global Financial Crisis of 2007-2009. Its primary goal is to strengthen the stability and resilience of the global banking system by addressing the weaknesses exposed during the crisis. Basel III was initiated to enhance risk management, improve banks' capital adequacy, and promote transparency in the financial sector.

Bond prices and interest rates are inversely related, meaning that when interest rates rise, bond prices typically fall, and vice versa. This relationship exists because bonds pay a fixed interest, or coupon, over their lifetime.

When market interest rates increase, newly issued bonds offer higher yields, making existing bonds with lower yields less attractive to investors. Consequently, the prices of existing bonds must decrease to match the new market conditions and provide a similar yield to maturity.

Conversely, when interest rates decrease, existing bonds with higher yields become more attractive, driving their prices up. This inverse relationship between bond prices and interest rates helps maintain equilibrium in the bond market.

A bank run is a financial phenomenon that occurs when a large number of customers simultaneously withdraw their deposits from a bank due to concerns about the bank's solvency or financial stability. This sudden surge in withdrawals can quickly deplete the bank's available cash reserves, as banks typically lend out most of their deposited funds and maintain only a fraction as liquid cash. A bank run can exacerbate the institution's financial distress, leading to potential insolvency, loss of confidence in the banking system, and, in extreme cases, a collapse of the financial system if it spreads to other banks.

Here’s a good overview by the New York Times of what happened in the US.

The technical roots of Cypherpunk ideas have been traced back to work by cryptographer David Chaum on topics such as anonymous digital cash and pseudonymous reputation systems. Over the next several years, these ideas morphed into the cypherpunk movement. Much the work and writings of that movement would later become the foundation of Bitcoin: