#124: Bitcoin Beats Alphabet

Circle vs Swift. Tether + SoftBank's $3.6B Bitcoin play. Ledger's debit card. Paypal drops Agentic Toolkit. LayerZero lands $55M. Hidden Road (Ripple) wins FINRA approval.

👋 Hey, it’s Marc.

Cantor Fitzgerald, Tether and SoftBank are launching Twenty One Capital — a $3.6B bitcoin buying machine far more ambitious than Microstrategy. This means:

The biggest USD stablecoin issuer on Earth

Now indirectly controls a publicly listed Bitcoin vault

With access to U.S. capital markets and investor flows.

This is a quiet revolution of capital markets.

Then: Hidden Road (recently acquired by Ripple) secured approval from FINRA to operate as a broker-dealer. Paypal dropped the 𝗣𝗮𝘆𝗣𝗮𝗹 𝗔𝗴𝗲𝗻𝘁𝗶𝗰 𝗧𝗼𝗼𝗹𝗸𝗶𝘁 — a full-blown suite to plug their APIs.

And, Bitcoin just became the world’s 5th most valuable asset, surpassing Alphabet with a $1.87T market cap:

“Bitcoin has a dual role as both a tech-correlated asset and a safeguard against private and public sector financial disruptions. It is regaining attention as a hedge against systemic risk as the concerns mount over the independence of the U.S. Federal Reserve.”

— Geoffrey Kendrick, Standard Chartered‘s Global Head of Digital Assets Research

This week’s question:

📚 Our 10 Top Reads This Week

AI in the Enterprise. OpenAI. Link

The Great Rewrite: AI, Bitcoin, and the Unraveling of the Old Monetary Order. Maja Vujinovic. Link

Type III Stablecoins. Stanford Blockchain Review. Link

The State of Crypto Lending. Galaxy Digital. Link

Stablecoins: The First ‘Killer App’. Standard Chartered. Link

Networks in Crypto VC. Decentralised.co. Link

What Circle Payment Network can learn from Facebook, Plaid, & Wise. Fintech Blueprint. Link

Sam Altman Talks ChatGPT, AI Agents and Superintelligence. TED. Link

Google Takes Aim at Cursor. 51x. Link

What Comes After Mobile? Perspective AI and Consumer Tech. a16z. Link

Circle vs SWIFT

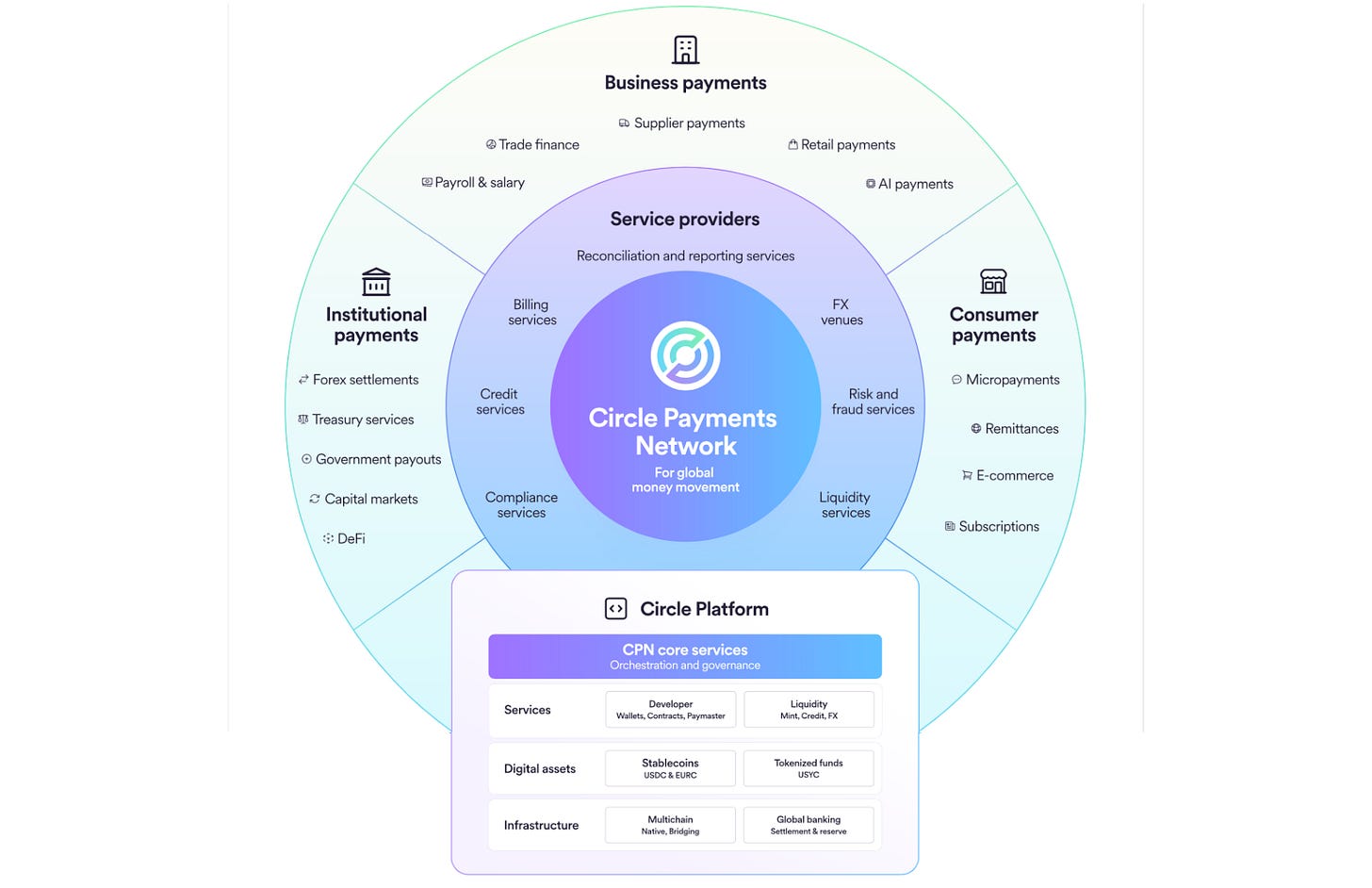

Circle will debut its Circle Payments Network (CPN) in May. [Announcement]

The goal? To enable real-time cross-border payments for financial institutions using USDC, EURC, and other regulated stablecoins.

What you should know:

What it is: A compliance-first payment protocol for fiat & stablecoins.

How it works: Banks and payment firms onboard via strict KYC/AML. CPN routes payments off-chain, settles on-chain—fast, cheap, programmable.

Use cases: Cross-border payroll, trade finance, remittances, AI payments, DeFi, e-commerce, micropayments.

Governance: Circle sets the rules, vets members, enforces AML/CFT, and ensures global compliance with travel-rule data sharing.

Ecosystem & Fees: Plug-and-play services for FX, risk, billing, liquidity. Revenue from payout fees, FX spreads, and network fees is reinvested into growth.

Why it matters: Cross-border payments are slow and costly—up to 6.65% in fees with multi-day delays. Circle’s CPN offers a faster, cheaper alternative by linking USDC and EURC to banks and real-time rails. It unlocks use cases like payroll and treasury, and positions stablecoins as next-gen payment infrastructure—putting pressure on SWIFT to evolve.

Yes, but: Banks across North America, Europe, and Asia will begin live trials for digital assets and currencies on SWIFT’s infrastructure.

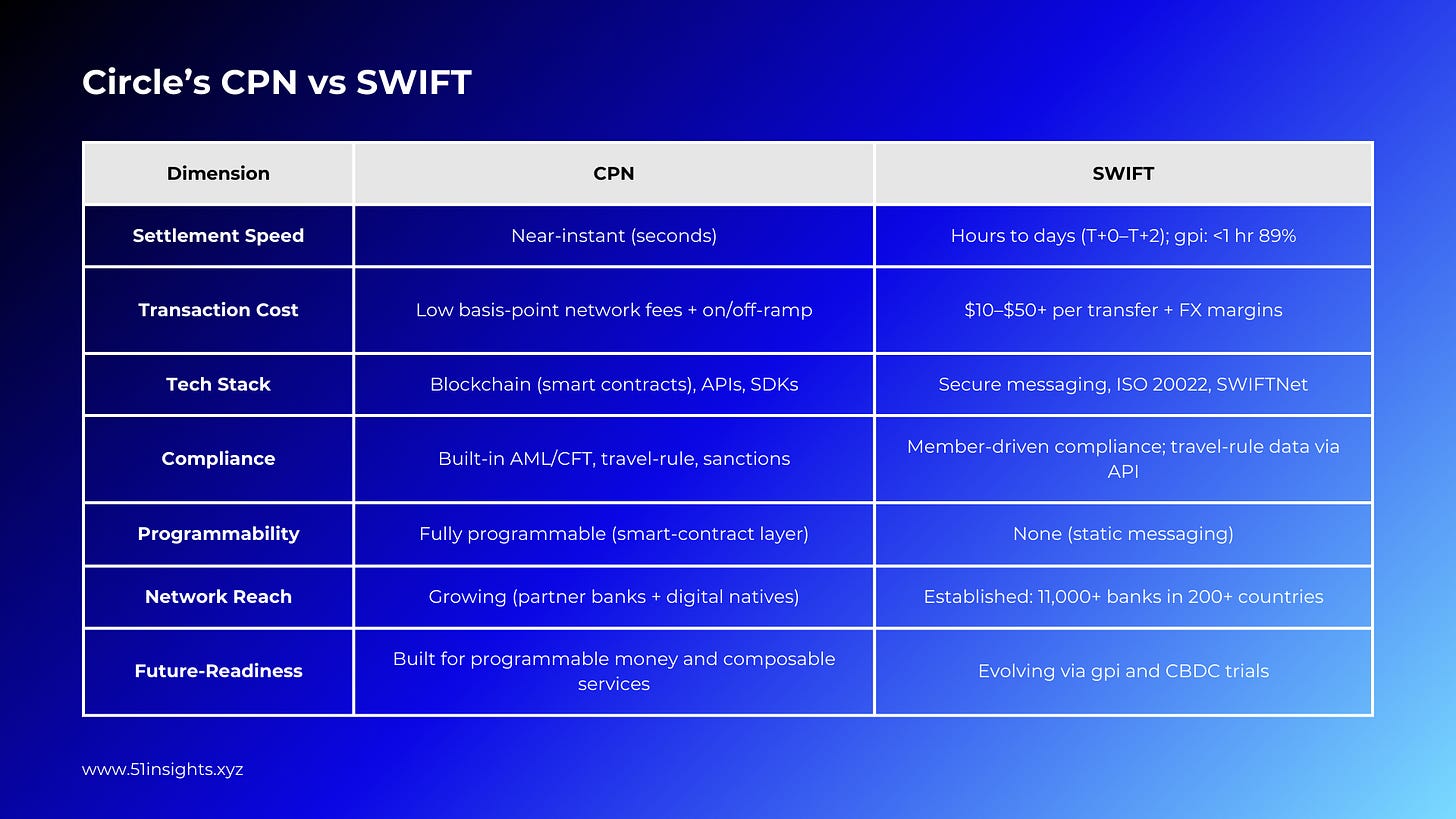

CPN vs SWIFT: As payments become embedded in software and AI agents transact on their own, legacy rails like SWIFT start to show their limits. Trusted but rigid, they weren’t built for speed, automation, or programmability.

Our take: For corporates, this means one thing: a dual-rail strategy is no longer optional—it’s essential. Legacy systems like SWIFT remain critical for large institutions with deep regulatory and banking ties. But for high-velocity use cases—cross-border payroll, AI-led procurement, smart contract settlements—rails like CPN will be the default.

Read the Whitepaper

51: We help companies like Avalanche, Near, or MoonPay with industry-leading thought leadership campaigns to attract institutional clients. Interested?

Ledger x Mercuryo

Mercuryo launched a Mastercard-powered crypto debit card, Spend, live via Ledger Live. [announcement]

It enables users to spend BTC & ETH directly at 150M+ merchants globally.

Key features:

Limits: €40,000 monthly spending cap; zero setup fees

Compatibility: Supports BTC, ETH at launch; stablecoins coming. Works with Apple Pay & Google Pay

Infrastructure: Integrated directly into Ledger Live, enabling real-time conversion of crypto into fiat

Security: Taps into Ledger's Donjon security lab and self-custody setup; AML/KYC built in via Mastercard

Expansion: EEA users first; global availability planned

Why it matters: Backed by Mercuryo’s infra + Mastercard’s network + Ledger’s security stack, Spend blends self-custody with real-world spending—without compromising control.

Our take: Ledger is shifting from secure storage to everyday spending. The gap between digital assets and real-world commerce is closing fast. The next wave crypto products won’t be won by hype—it’ll be won by products people trust and actually use.

🚨 News Flash

Cantor x Tether x SoftBank: $3.6B Bitcoin bet. Link

PayNation rolled out a crypto-powered B2B payment solution. Link

Hidden Road secured approval from FINRA to operate as a broker-dealer. Link

Paypal dropped the 𝗣𝗮𝘆𝗣𝗮𝗹 𝗔𝗴𝗲𝗻𝘁𝗶𝗰 𝗧𝗼𝗼𝗹𝗸𝗶𝘁 — a suite to plug their APIs. Link

Dorsia integrates MoonPay to enable crypto payments. Link

PayPal is launching a 3.7% annual yield on its PYUSD stablecoin. Link

Slovenia proposes 25% tax on crypto transactions. Link

👉 Keep up with all our signals for Web3 execs on our Telegram channel.

💰 Money Moves

Bitdeer: Bitcoin mining company raised $179M in Loans and Equity. Link

Auradine: AI infrastructure solutions raised $153M Series C led by StepStone Group. Link

LayerZero: Interoperability protocol raised $55M led by a16z. Link

Symbiotic: Restaking platform raised $29M led by Pantera. Link

ZND: Digital finance platform raised $20M led by Rollman Management Digital. Link

Analog: Blockchain startup raised $15M led by Bolts Capital. Link

That’s all for now, folks.

Talk soon,

– Marc & Team