📝120: xAI acquires X

OpenAI's new killer model. USDC enters Japan. Trump launches stablecoin. Marina Abramović goes crypto. Visa + Worldcoin go live. Kraken preps IPO. Crocs land in Fortnite. Top reads & more.

👋 Hey, it’s Marc.

Today, Elon Musk’s xAI acquired X valued at $80B and $33B respectively. What does that mean for privacy? We broke it down.

This week, Paradigm published a top report on TradFi’s crypto adoption. You should read it.

Then: Marina Abramović launched her NFT collection. Cool. The real story? Stablecoins are going mainstream:

USDC goes to Japan. Circle’s stablecoin is now globally recognized — and regulated — in one of the toughest jurisdictions.

Visa + Worldcoin launched World Wallet, mixing stablecoins and card payments.

Trump’s World Liberty Financial launched USD1. Meanwhile, Fidelity and Wyoming are launching their own stablecoins.

The STABLE Act is here — regulators are finally trying to get ahead.

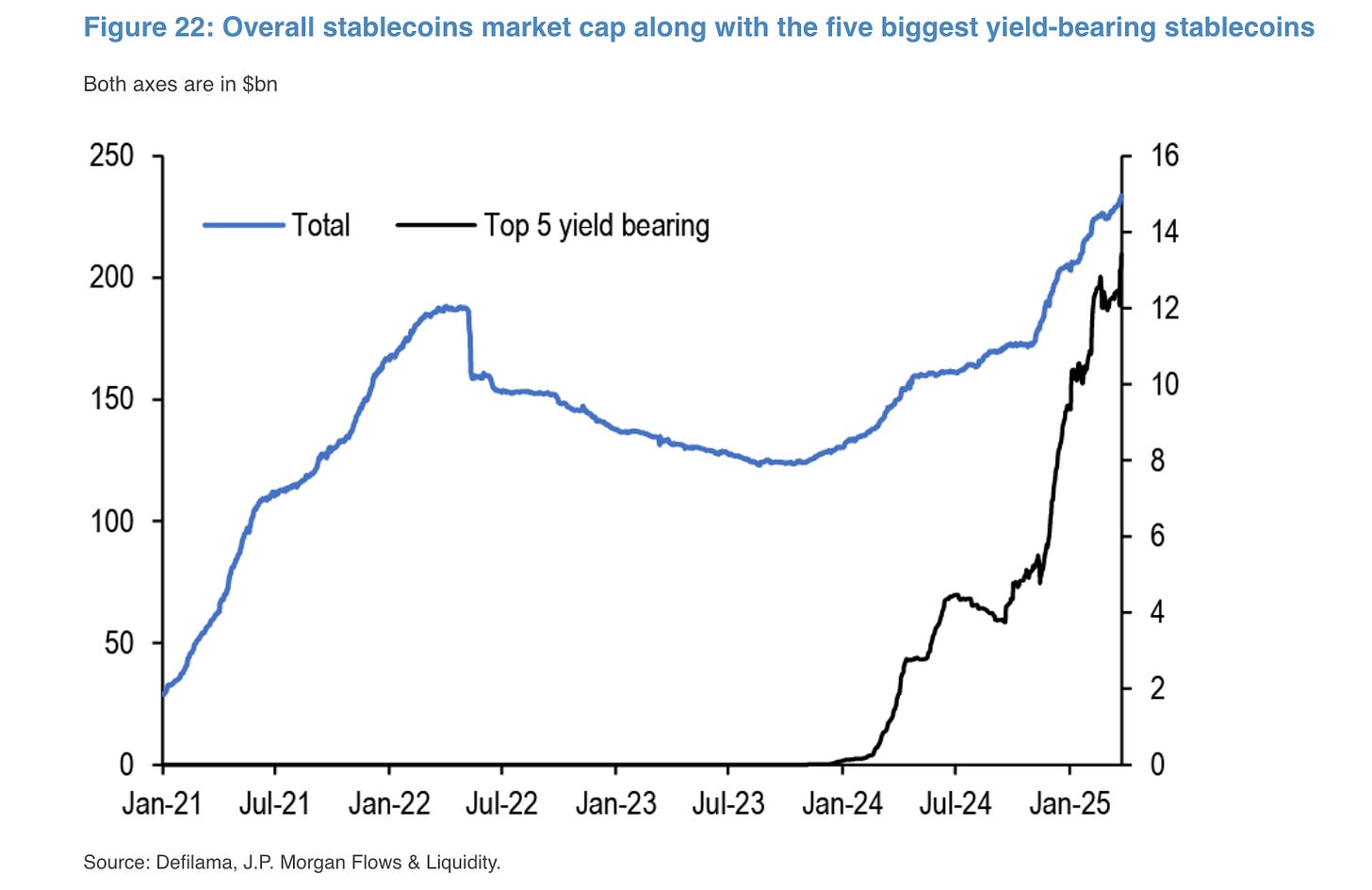

JPMorgan says yield-bearing stablecoins could hit 50% of the market — up from 6% today.

“The top five yield-bearing stablecoins — Ethena's USDe, Sky Dollar's USDS, BlackRock's BUIDL, Usual Protocol's USD0 and Ondo Finance's USDY— have seen rapid growth since the U.S. election in November, rising from around $4B to over $13B in combined market cap.”

— Nikolaos Panigirtzoglou, MD-Global Market Strategy, JP Morgan

This week’s question:

📚 Our Top Reads This Week

Blackbird: Revolutionizing the Restaurant Business with Blockchain. Link

TradFi tomorrow. Paradigm. Link

The AI Hype Index. MIT Tech Review. Link

Agent MPC is going wild. 51x. Link

The State of Onchain Futarchy. Galaxy. Link

Battle of the EVM Chains: Who’s Winning the Giga Gas War? Delphi Digital. Link

Steil and Hill Introduce STABLE Act [Bill]. Link

DeAI is eating AI. 51x. Link

Circle Enters Japan

Circle is working with SBI Holdings to bring USDC to market through Circle Japan KK.

Why it matters: Japan has clear stablecoin regulations and a strong Web3 ecosystem. With a dedicated local presence and major partners, Circle is positioning USDC as the go-to digital dollar for Japanese businesses and institutions.

Be smart: USDC becomes the first and only global dollar stablecoin approved for use in Japan.

What you should know: SBI VC Trade launched USDC on March 26, backed by regulatory approval. Binance Japan, bitbank, and bitFlyer are set to follow with future listings.

By the data: The USDC market cap exceeded $60B for the first time on Thursday.

What they’re saying:

“We have spent 2+ years engaging with Japan's regulators, major industry players, strategic parnters, banking partners and others to enable USDC for the Japanese market, which unlocks tremendous opportunites not just in trading digital assets, but more broadly in payments, cross border finance and commerce, FX and more.”

— Jeremy Alliare, Co-founder & CEO, Circle

Our take: Japan isn’t a crypto free-for-all—it’s a yen-dominated market with a deep-rooted preference for local financial systems. Circle’s USDC may have regulatory approval, but adoption is the real challenge. Japanese businesses and consumers won’t switch unless USDC offers clear advantages—cheaper cross-border payments, better liquidity, or seamless integration. And with Japan’s past crypto scars (Mt. Gox) and a strong bias for domestic solutions, a U.S.-backed stablecoin faces an uphill battle. If Circle doesn’t lock in adoption fast, yen-backed alternatives could quickly take over once regulations allow them.

Other Circle’s updates:

Intercontinental Exchange (ICE), parent of the NYSE, is teaming up with Circle to explore integrating USDC and US Yield Coin (USYC) into traditional finance.

GCash now lets users buy, hold, and transact with Circle’s USDC stablecoin through its GCrypto platform.

OpenAi’s Ghibli Effect

OpenAI’s GPT-4o now lets ChatGPT and Sora users create and edit images directly in chat. [Announcement]

Why it’s important: Early results are turning heads: the model can render photorealistic hands, generate legible text, and mimic cinematic styles.

Be smart: AI-generated Studio Ghibli-style images flooded social media after this update. Now you know why all your friends changed their profile pic.

Memecoin effect: The Solana-based Ghiblification (GHIBLI) hit a $20.8M market cap in just 19 hours, nearly +40,000%. At least 20 other Ghibli-themed tokens have popped up, sparking hopes of a memecoin revival after a 57% market slump since December.

Zooming out: The company has raised $19B+ in equity funding to date — dwarfing every other player in the space. Can smaller companies even keep up?

Butterfly Effect’s Funding Round

Butterfly Effect, builder of AI agent Manus, is in talks with U.S. venture firms to raise a new funding round at a $500M+ valuation—5x its previous $100M.

But: The talks play out amid rising U.S.-China tech tensions, posing risks and rewards for American investors.

Be smart: Manus sparked significant buzz among U.S. tech executives and AI developers 2 weeks ago with its beta launch. [Watch demo]

It is positioned as the "World’s First General AI Agent" and uses multiple AI models (Claude 3.5, Qwen, etc.) and independent agents for autonomous task execution.

Stepping back: U.S.-China tech tensions are escalating, with new 2025 rules restricting American investments in Chinese AI firms. The rules target foundational AI models, but Butterfly Effect’s application-focused AI, like Manus, may avoid scrutiny—for now.

Why it’s important: Manus is riding the wave of AI demand, with a massive U.S. waitlist (~2.6M) and a smart dual-market strategy. By expanding to Japan and working with Alibaba in China, Butterfly Effect is hedging against U.S.-China tensions while tapping into high-growth markets. For investors, its global approach offers both scale and resilience in the AI agent race.

Devil’s Advocate: Manus’s hype justifies Butterfly Effect’s $500M valuation jump, but its cash burn is steep—$1M on Claude models in two weeks, with costs at $2 per task. Scaling is constrained by server capacity, making new funding critical. Optimizing costs and expanding infrastructure could unlock revenue, but profitability remains a long-term challenge.

Our Take: Butterfly Effect is a high-upside bet with serious risks. Manus’s viral traction and 2.6M waitlist justify its $500M valuation, but its $1M burn in two weeks is a red flag. Scaling while cutting costs is crucial, but the bigger threat is geopolitics— U.S. scrutiny of Chinese AI firms could derail growth or block exits. With deep-pocketed rivals in the AI agent space, execution speed is everything. For investors, this is either a 10x play or a costly misstep.

👉MIT Technology Review: Testing Manus AI

🚨 News Flash

Kraken eyes a $1B debt raise ahead of a potential 2026 IPO. Link

Custodia Bank and Vantage Bank launched the Avit stablecoin. Link

CME Group pilots asset tokenization using Google Cloud’s Universal Ledger. Link

World Liberty Financial has launched USD1, a non-tradable stablecoin. Link

Worldcoin to develop World Wallet with Visa. Link

Marina Abramović launches her NFT collection. Link

Crocs launches on Fortnite. Link

NYX Professional Makeup’s new Minecraft Movie-inspired collection. Link

Cartoon Network’s major update on Roblox. Link

👉 Keep up with all our signals for Web3 execs on our Telegram channel.

💰 Money Moves

Tabit: DeFi Protocol secured a $40m Bitcoin-funded facility. Link

Chronicle Protocol: Infrastructure company raised $12M in Seed funding, led by Strobe Ventures. Link

That’s all for now, folks.

Talk soon,

– Marc & Team

51: We help companies like Avalanche, Near, or MoonPay with industry-leading thought leadership campaigns. Interested? Start dominating your vertical.

More feedback? Reply to this email.