📝#102: Tether Enters $3B Tokenization Market

Tether launches tokenization platform. Sky (Maker) launches USD stablecoin on Solana. Tether, Kraken & Fabric Ventures invest in EUR stablecoin issuer. Global e-sports team launches on Sui.

Hey, it’s Marc ✌️

We’ll soon publish the most comprehensive stablecoin report for business leaders. The first 100 people who sign up will get it for free. Sign up here.

“If Apple bought $100B of Bitcoin, it would likely grow to $500B, and the company would have a $500B business growing at 20% a year.”

Michael Saylor, Founder & Chairman, Microstrategy

This week’s question:

👉 Keep up with all our signals for Web3 execs on our Telegram channel.

Let’s dive in🦈

📚 Our Top Reads This Week

Skoda’s Web3 playbook. 51 Insights. Link

USDC and The Future of the Dollar. Stanford. Link

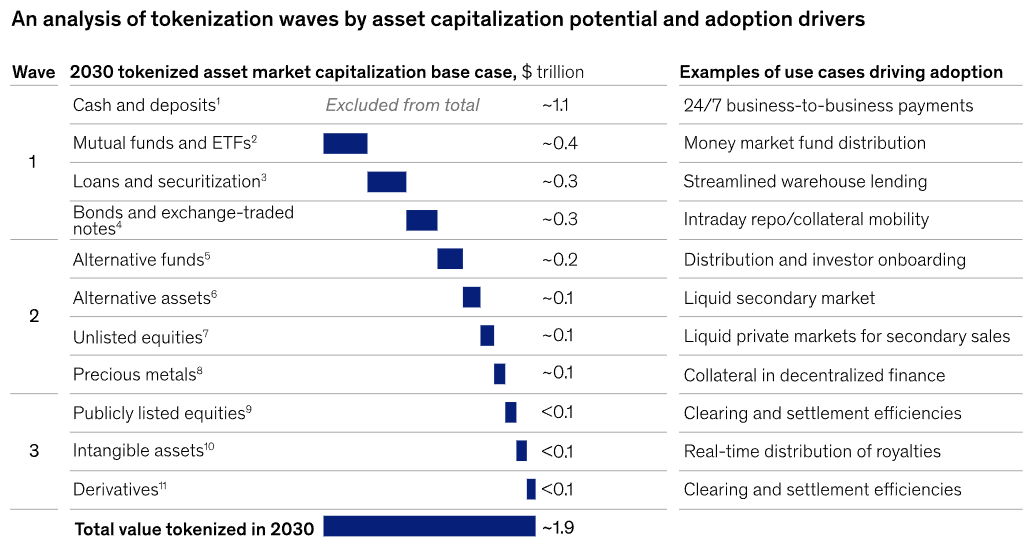

From Ripples to Waves: The Transformational Power of Tokenizing Assets. McKinsey. Link

The State of GenAI in the Enterprise 2024. Menlo Ventures. Link

Meta expands into AI Tools for the Enterprise. Michael Parekh. Link

How to Mitigate Gen AI’s Risks. HBR. Link

The Economics of AI Agents. Lisa JY Tan. Link

Work With Us & Reach 50k+ Corporate Leaders

Our industry OGs, vast network, research team & 50k+ B2B audience help you:

Co-publish enterprise-grade reports with us, driving traffic and boosting B2B outbound conversion rates.

Execute a multi-channel growth campaign that delivers better results than anything else in Web3's consumer space.

Is Tether Emerging as a Blockchain Leader?

Tether has introduced Hadron, an asset tokenization platform. [annoucement]

Why it matters: Hadron signals Tether’s ambition to expand beyond stablecoins into the broader financial markets. It allows Tether to define the standards for tokenization, much like it did for stablecoins.

What you should know:

Simplified Tokenization: Enables the tokenization of various assets, including stocks, bonds, stablecoins, loyalty points, and more.

Compliance Tools: Features advanced KYC, AML, Know-Your-Transaction, and risk management capabilities for secure and regulated token issuance and management.

Asset Support: Supports fiat-pegged and commodity-backed stablecoins, as well as digital asset-collateralized tokens and basket-collateralized products.

The opportunity: The tokenized market is set to surge 40.2% annually, hitting $2T by 2030. With the Banking, Financial Services, and Insurance (BFSI) sector driving 19% of revenue through the tokenization of sensitive data, Tether’s Hadron is primed to seize this opportunity.

Stepping back: In Oct 2024, Visa launched the Visa Tokenized Asset Platform (VTAP) on Ethereum. [Read more]

The big picture: Tether is positioning itself as an infrastructure leader in the cryptocurrency and digital finance space. Recently:

It launched an open-source wallet development kit for AI Agents & builders. Link

It launched Alloy, a gold-backed stablecoin designed to track the US dollar. Link

Meanwhile: Bitfinex Securities (also owned by iFinex) has launched tokenized U.S. Treasury Bills in El Salvador, leveraging the country's digital asset-friendly regulations.

The Stablecoin Race🏇

The stablecoin narrative is getting stronger. This week:

Sky, formerly Maker, has launched its USDS stablecoin on Solana, offering a stable, efficient, and scalable solution for lending, trading, and payments.

Tether along with Kraken and Fabric Ventures is investing in Quantoz to launch MiCAR-compliant stablecoins (EURQ & USDQ), leveraging Hadron by Tether for tokenization.

Meanwhile: Binance, not to be outdone, launched BFUSD, a stablecoin-like yield-bearing token offering up to 20% APY for futures traders.

The question arises: Are companies just following footsteps, or is there real demand? Are stablecoins truly addressing a gap in the financial system, or are they simply a solution in search of a problem?

And, with the rise of euro- and dirham-pegged stablecoins, will they offer true utility, or will USD-pegged tokens continue to dominate?

We’ll explore these questions and dive into the practical use cases for stablecoins in our upcoming report. Subscribe for insights on what’s next in the stablecoin evolution.

Esports Embraces Blockchain🎮

Team Liquid, one of the most successful and recognizable esports organizations with 10M+ fans globally, introduced the MyBlue fan engagement platform on the Sui blockchain.

Key Features:

Fan Experience: Claim and customize your Blue avatar, Team Liquid’s mascot, through quests.

Customization: Unlock unique features and accessories based on your activity, including exclusive items.

Reward System: Earn real-world perks like exclusive merch, signed jerseys, and esports event trips.

Why it matters: Esports teams are struggling in monetization, and rely heavily on sponsorships, with some seeing up to 95% of revenue from them. Yet, 81.3% are unsure how to build sustainable revenue. Web3 technology, with its fan retention and data-driven insights, offers a path to solving this challenge and deepening audience connections.

Zooming in: MyBlue lets fans claim a customizable avatar and earn exclusive items tied to major events like Dota 2’s The International.

With 76% of esports fans being Gen Z or Millennials—less inclined to spend on traditional merchandise—Web3 loyalty programs offer a digital-first solution. This opens up new revenue streams through content, merchandise, and digital assets.

By the data: 52% of Gen Z gamers spend money regularly on games, and 18% are willing to spend $50-$100 monthly on virtual items.

The big picture: While this is all an experimentation, Team Liquid is at the forefront of this shift, using tools like Liquipedia—its world-leading esports tracker that collects user data to drive advertising revenue—demonstrating how esports can effectively tap into new revenue channels.

🚨 Other Highlights You Can’t Miss

Perplexity launched an AI-powered shopping platform. Link

Bluesky, the decentralized social network, surpassed 20M users. Link

McDonalds collaborated with Doodles to launch holiday cups. Link

Grayscale launched Bitcoin ETF option trading. Link

Watford FC offers tokenized equity through the Avalanche blockchain. Link

A Chinese lab has released a ‘reasoning’ AI model to rival OpenAI’s o1. Link

🚨 Top Under-The-Radar Macro Signals:

USA:

Trump is reportedly considering Teresa Goody Guillén, a pro-crypto lawyer and former SEC attorney, to lead the SEC.

Trump has nominated Howard Lutnick, CEO of Cantor Fitzgerald and a pro-crypto, to lead the Commerce Department

Regulation:

On the enterprise side: Michael Saylor will pitch a Bitcoin treasury strategy to Microsoft’s board next month. Microsoft, with $78B in cash reserves, has so far resisted such moves.

MicroStrategy bought 51,780 BTC for $4.6B, bringing its total to 331,200 BTC—1.6% of Bitcoin’s supply and surpassing the US government’s holdings.

Goldman Sachs will spin off its blockchain-based trading platform, aiming to streamline trading and boost institutional blockchain adoption.

👉 Keep up with all our signals for Web3 execs on our Telegram channel.

💰 Money Moves

Canaan: Bitcoin mining company raised $30M through equity financing. Link

Monkey Tilt: Online gambling platform raised $30M led by Pantera. Link

Noble: Blockchain infrastructure company raised $15M led by Paradigm. Link

Bitfinity: Blockchain company raised $12M led by ParaFi Capital and Draft Ventures. Link

That’s all for now, folks.

Talk soon,

– Marc & Team

More feedback? Reply to this email.