I’ve been in crypto for eight years, and I’ve never seen a technology move this fast.

Entire industries are being forced to recalibrate in real time. If you’re not paying attention, you’re already behind.

We put this report together with the CEO of OGroup, Maja Vujinovic, to save you time and cut through the noise:

The Evolution of AI: From Transformers to Multimodal Models

The AI Compute Race: Cost, Scalability, and Infrastructure Needs

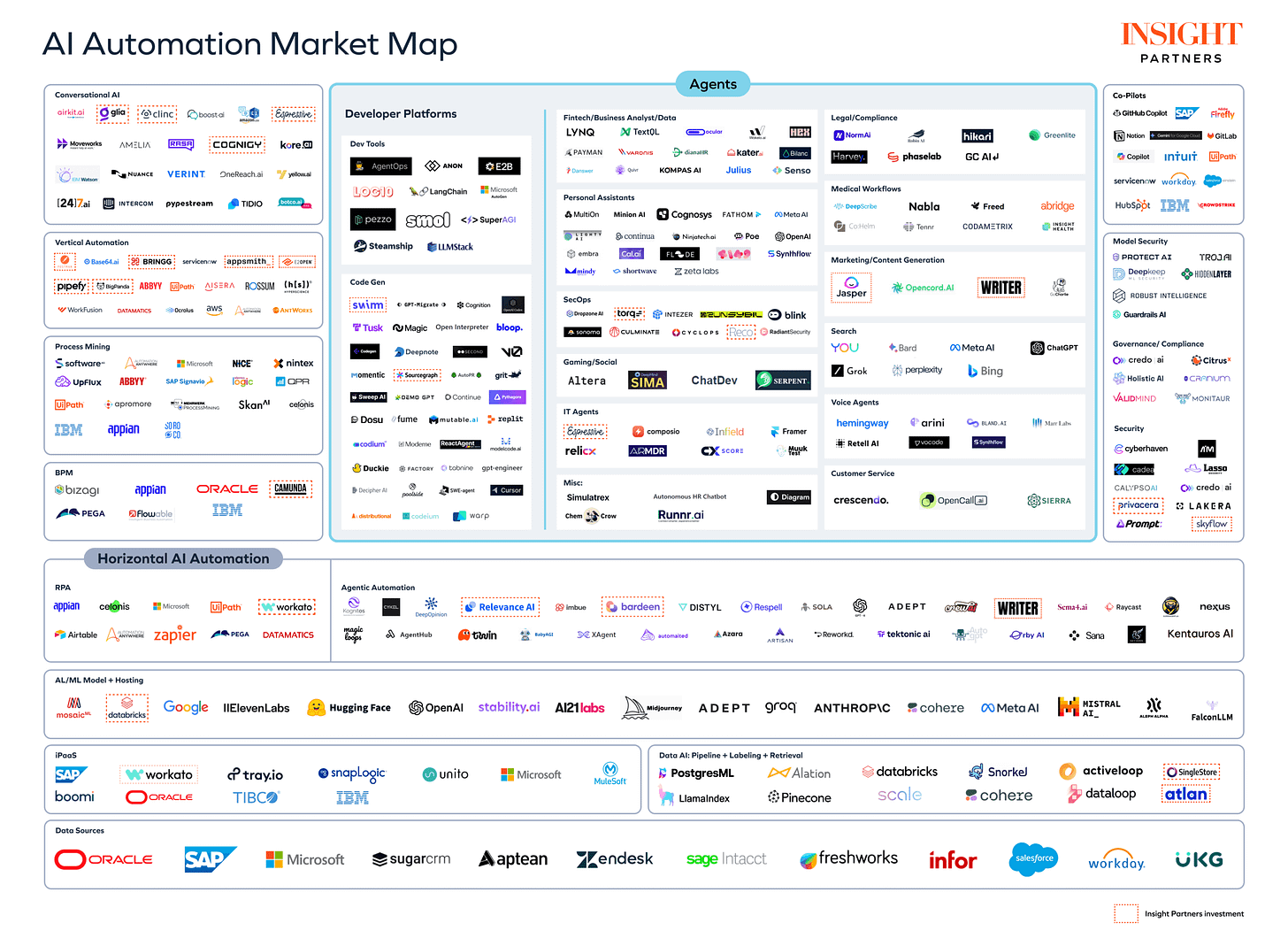

The Shifting AI Business Model: From Chatbots to Autonomous Agents

Where Capital Will Flow Next

Regulatory Pressures and Geopolitics

AI’s Billion-Dollar Opportunities: What Comes Next?

Future Predictions

Let’s jump in🦈.

Foreword: AI’s Real Edge

Who Wins, Who Loses, and What Comes Next?

AI is no longer an experiment—it’s a reckoning. Some companies will harness it to dominate their industries. Others will spend billions and see no return. The question isn’t who has the best model, but who is building AI that actually delivers competitive advantage?

Billions of dollars are flooding into AI, yet many enterprises still struggle to turn it into true business value. Hedge funds use AI traders, law firms automate contract review, and large corporations optimize workflows—but which companies will use AI to reshape entire industries? AI’s true competitive advantage lies in its ability to drive revenue, not just efficiency.

But the battle isn’t just corporate—it’s geopolitical. Compute power is the new oil. Nations are scrambling to secure access to critical compute power. China’s DeepSeek-V3 proves it can build world-class AI without U.S. chips. The UAE and Saudi Arabia are buying their way into AI dominance. Meanwhile, Europe’s heavy-handed regulation might protect consumers but could also stifle innovation. Where does that leave Africa and Latin America? Are they the next AI markets—or just the next digital colonies?

For corporate leaders and investors, the real opportunity is not in owning AI models but in owning AI distribution and utility. The companies that will win are those that:

Turn AI from a cost-cutter into a revenue driver—Who’s using AI to build entirely new business models, not just replace workers?

Bet on industry-specific AI, not just general models—The next AI unicorns won’t build chatbots—they’ll build AI that revolutionizes supply chains, finance, and legal work.

Control AI distribution, not just development—The real power lies in who gets AI into businesses at scale, not who trains the largest model.

The AI investment landscape is shifting. Capital is moving away from compute-heavy, inefficient models and toward leaner, more effective AI with measurable impact. The next phase of AI dominance will be defined by who delivers AI that businesses, consumers, and governments can’t afford to ignore.

This paper isn’t just about what’s happening in AI—it’s about who will win, who will lose, and where the next wave of AI-driven business opportunities will emerge—and challenges you to think beyond the hype.