The "Netscape Moment" for DeFi (And how to trade it)

[Our daily CEO briefing for PRO readers; PDF at the bottom]

The largest DeFi lender just solved the biggest problem in crypto.

Aave ($30.92B TVL) just shipped the first mass consumer finance app that successfully hides the blockchain. No seed phrases. No gas fees. Just a normal app offering up to 9% yield (18x the national savings average) to everyday users. [RELEASE]

The Opportunity: Our analysts believe this shift will trigger a massive repricing of “Middleman Fintechs” and a premium for “Full Stack Protocols.”

Let’s unpack.

(PRO readers: PDF below & investor alpha at the bottom)

What happened

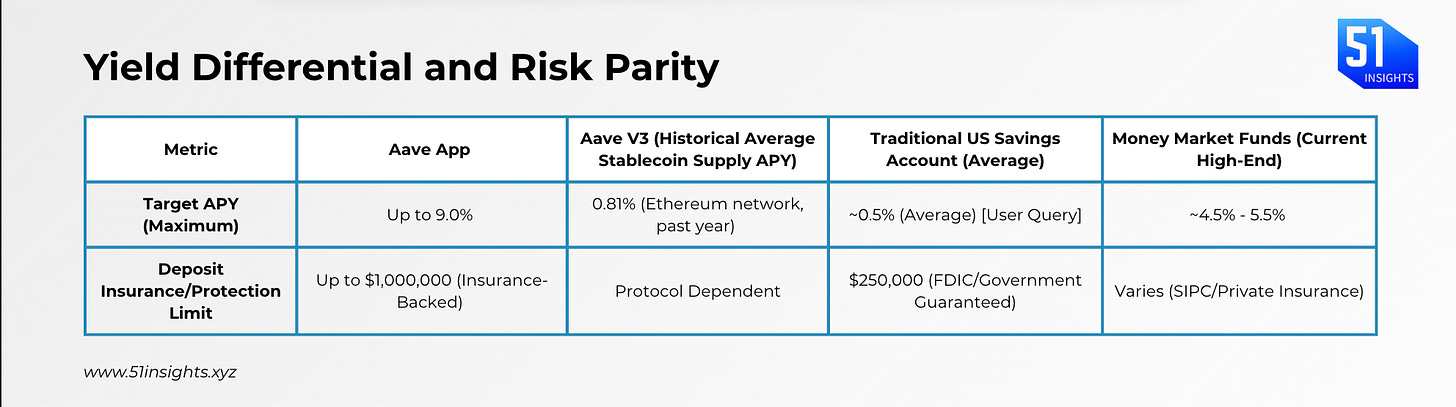

Aave is launching a mobile app that enables you to deposit funds from your bank account and earn a yield of up to 9%. That’s 18x higher than your average savings account (0.5%) and higher than money market funds. On top of that, Aave will offer a $1M balance protection, which is unheard of in TradFi (the FDIC provides deposit insurance of up to $250k per depositor, per insured bank).

The application supports frictionless funding, allowing users to deposit from their bank accounts or debit cards, supporting over 12,000 banks, or via stablecoins.

This pivot was formally initiated by the acquisition of Stable Finance, a San Francisco-based fintech startup, announced in October 2025.

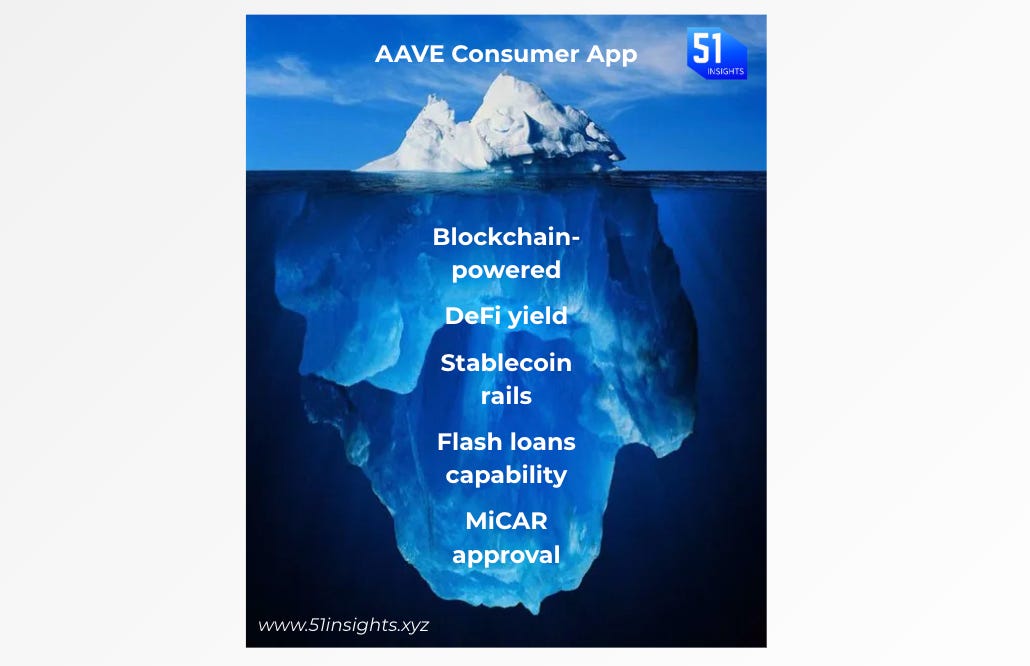

The thesis: Aave is launching a normal-looking fintech app, while delivering far better economics by routing deposits through efficient decentralised markets.

This makes Aave a structural competitor to banks.

How Aave competes against fintech and banks:

Subsidized yield as a growth weapon: The 9% return is a deliberate incentive to win customers. The minimum “base” rate is 5%. 4% is on top and requires verified user + auto-deposits or referrals. This is likely subsidized to drive adoption and not sustainable. And the base rate is likely an estimated, optimistic average from Aave based on average lending interest across the platform.

A regulated door into Europe: By getting MiCA approval for its on-ramp, Push, Aave created a fully compliant way for Europeans to move money directly into DeFi, without depending on exchanges. That’s a major structural advantage.

By successfully wrapping complex infrastructure in a consumer-grade interface, Aave’s new app is a ‘Netscape Moment’ that signals the inevitable future of on-chain banking.

Aave is essentially building a retail savings model that manages risk through overcollateralized lending and formal KYC, a differentiator from the fractional-reserve system banks rely on. Its link-up with Ethena shows how it’s becoming a major distribution engine for on-chain yield. Ethena creates high, risk-adjusted returns through its synthetic dollar USDe, built using a delta-neutral strategy that captures funding rates from perpetual futures markets. Aave provides the infrastructure to scale that yield, with deep liquidity, leverage, and a lending market.

The strategy is clear: capture regulated retail deposits, route them into the best on-chain yield sources, and position Aave as the main channel and safety layer.

🙌 Work with us: We arm financial institutions and digital asset leaders with bespoke research, thought leadership to shape the most important conversations, scale trust, and win business.

Why it matters

The “Netscape Moment” for DeFi. This is the first time a DeFi protocol has successfully hidden the “crypto.” No wallets. No crypto UX. A user simply downloads an app from the App Store and earns up to 9%. Aave has effectively passed the “Grandma Test.” This expands the Total Addressable Market (TAM) from ~50M crypto-natives to ~5B smartphone users instantly.

Unlocking the “DeFi Backend” Economy. This proves that complex financial engineering can be wrapped in consumer-grade UX. It opens the floodgates for a new wave of apps where the “bank” is just code in the background. We’ll likely see a host of protocolsmoving up the stack to own the customer relationship. If Aave succeeds here, every major DeFi protocol (Uniswap, MakerDAO, Compound) will launch a consumer app within 12 months to defend their liquidity.