SWIFT's picks Ethereum

[Our daily CEO briefing for PRO readers]

SWIFT announced Sept 29 it will launch a blockchain-based ledger with ConsenSys and 30+ major banks - JPMorgan, HSBC, Citi, BNP Paribas, Deutsche, Santander, Wells Fargo, BNY Mellon, and more. The system will enable real-time, 24/7 cross-border settlements using tokenized deposits and smart contracts. [RELEASE]

Why it matters: SWIFT moves $150 trillion annually through 11,500 institutions. But settlements take 5 days with multiple intermediaries, hidden fees, and manual AML checks. Meanwhile, stablecoins scaled from $20B (2020) to $300B today, processing trillions annually. Banks are losing material cross-border payment share. SWIFT’s move is defensive but necessary.

Let’s dig in.

What happened

Swift will prototype a shared ledger with Consensys’s Linea L2 (Ethereum Layer 2 with zkEVM privacy features), designed for real-time, 24/7 cross-border payments. The ledger will record and validate transactions, enforce rules with smart contracts, and interoperate with both existing fiat rails and emerging digital networks.

Participants: SWIFT (membership of ~11,500 firms) + ConsenSys (Ethereum stack expertise) + 34 financial institutions across 16 jurisdictions. Chainlink provides oracle infrastructure and CCIP (Cross-Chain Interoperability Protocol) to connect legacy systems with public and private blockchains.

Zooming in: By moving to a blockchain-based ledger, Swift is:

Extending its role from messaging to actual settlement infrastructure.

Creating interoperability between banks, stablecoins, and tokenised assets.

Offering programmability (via smart contracts) for liquidity management, compliance, and settlement automation.

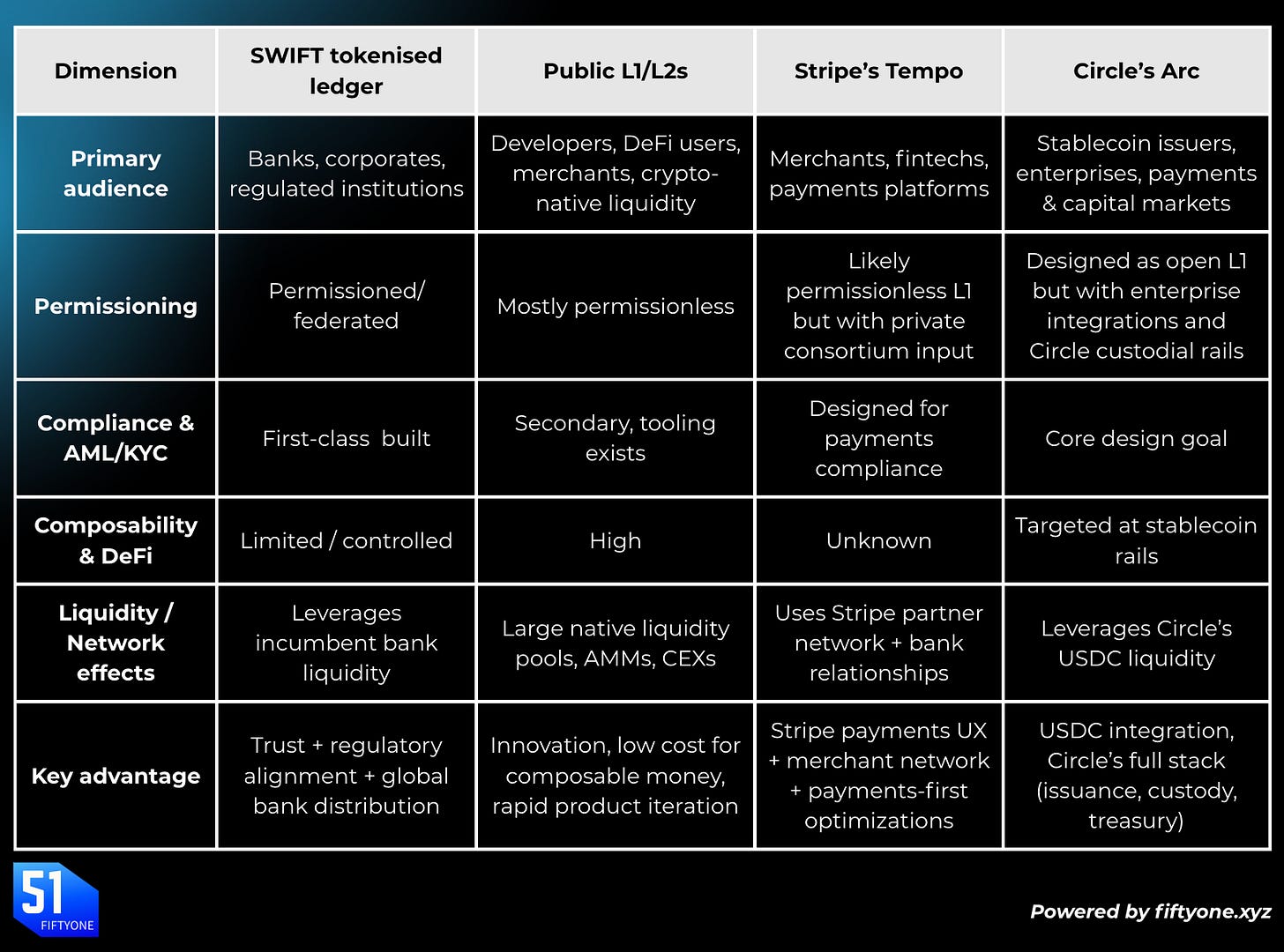

Arc: optimisation for institutional capital market needs

Tempo: payments-focused, optimised for commerce, payroll, and remittances

SWIFT: integrating DLT with existing correspondent banking/ISO standards

Why now

Stablecoins represent an existential threat to SWIFT’s correspondent banking model. Correspondent banks are losing billions in high-margin cross-border flows to crypto rails that settle in seconds, not days. SWIFT needed to move from messaging to settlement or risk becoming irrelevant.

If banks lose control of digital payment rails to Circle, Stripe, and Coinbase, they lose the most profitable part of their treasury services business. SWIFT gives them a way to offer blockchain speed while keeping vendor control in-house.