Ripple's $40B valuation, better than Circle?

[Our daily CEO briefing for PRO readers; PDF at the bottom]

Ripple raised $𝟱𝟬𝟬𝗠 𝗮𝘁 𝗮 $𝟰𝟬𝗕 𝘃𝗮𝗹𝘂𝗮𝘁𝗶𝗼𝗻, backed by Citadel and Fortress. [NEWS]

Other backers? Brevan Howard, Marshall Wace, Pantera Capital, and Galaxy. Ripple might have leapfrogged Circle and Tether.io as the vertically integrated and globally compliant financial infrastructure provider.

Unlike them, Ripple doesn’t just issue money. It owns the pipes.

Let’s unpack.

(PRO readers: PDF below)

What happened

In just over two years, Ripple has developed a comprehensive five-pillar institutional stack, transitioning from its initial use case of cross-border payments:

Custody: Acquired firm Metaco ($250M in 2023); 75 regulatory licenses globally

Payments & Stablecoins: Leveraging Rail and RLUSD (in Dec 2024)

$95B processed through Ripple Payments in 2025; RLUSD hit $1B market cap

Treasury management: Integrating GTreasury (acquired in Oct 2025 for $1B) to provide a direct gateway into corporate liquidity flows

Prime Brokerage: Operating Ripple Prime (aka Hidden Road; acquired in Apr 2025 for $1.25B); handles $3T annually, moves $10B/day, 50M daily transactions

XRP-ledger: A decentralised, open-source blockchain

The thesis: own the full stack that moves institutional money, not just the money itself.

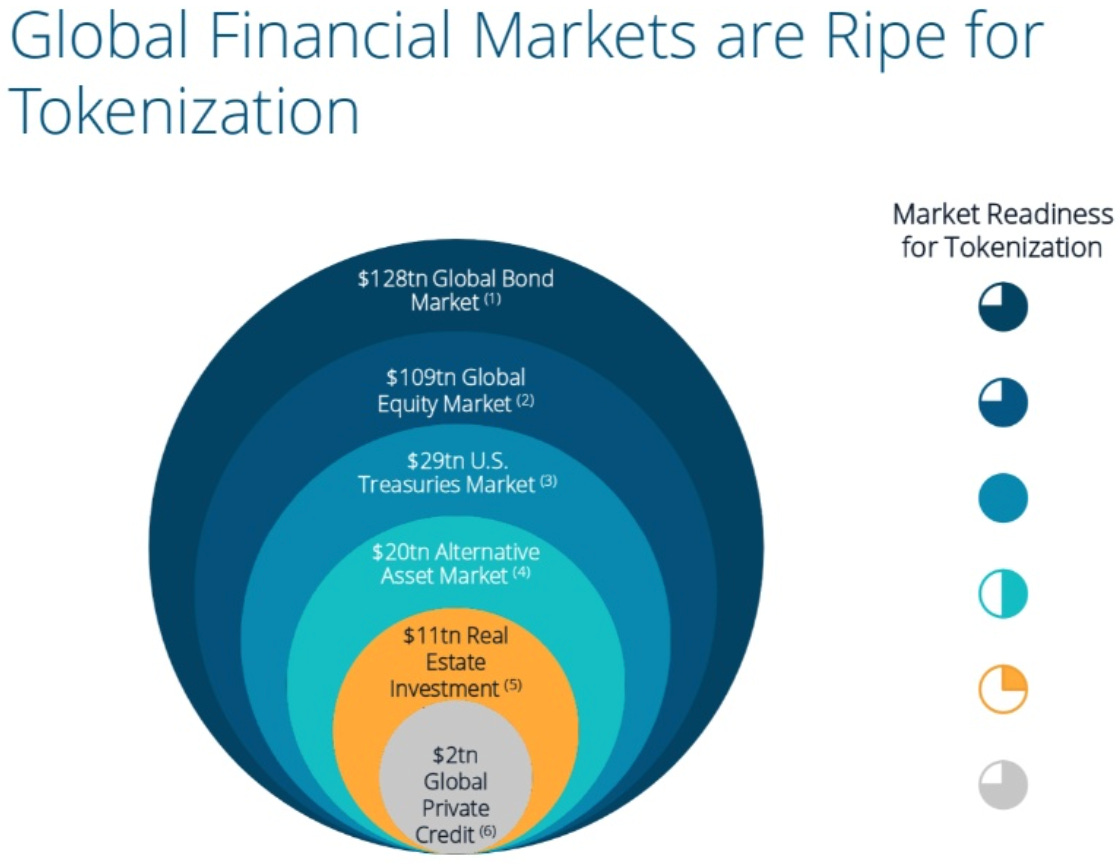

The catalyst: Tokenisation. Ripple is positioning its consolidated infrastructure as the critical liquidity and workflow bridge for $19T RWA tokenisation market.

The infrastructure play: Ripple Prime clears $3T annually across digital assets, FX, and fixed income for 300+ institutional clients. It’s the core utility layer that makes RLUSD and RWA collateral actually usable for hedge funds and asset managers.

The mechanism: XRP acts as a bridge currency for On-Demand Liquidity (ODL) outside the U.S., enabling cross-border settlements without pre-funded accounts. ODL volumes are up 41% quarter-over-quarter, topping $2.7B monthly. In the U.S., Ripple long relied on USDT due to regulatory uncertainty. That’s changing.

The institutional validation: BlackRock, Fidelity, and VanEck launched XRP ETFs holding $1.9B in assets within one month. XRP corporate treasuries hit $2B in announced commitments, led by Evernorth. Ripple is piloting stablecoin settlements with Mastercard, WebBank, and Gemini using RLUSD on XRP Ledger.

🙌 Work with us: We arm financial institutions and digital asset leaders with bespoke research, thought leadership to shape the most important conversations, scale trust, and win business.

Why it matters

The valuation makes no sense, until it does. Circle’s USDC is 75x larger than RLUSD ($73B vs $1B), yet Ripple is valued at 1.7x Circle’s valuation ($23.72B). Investors aren’t buying token metrics. They’re buying the only vertically integrated stack that connects corporate treasuries (GTreasury), institutional prime brokerage ($3T clearing), and stablecoin settlement in one workflow.