Just Do It: How Nike's Industry-Leading Web3 Strategy Marks a New Era for Consumer Brands

Nike continues to be the benchmark for consumer brands entering Web3. This is the definitive case study on Nike's Web3 strategy and how this marks a paradigm shift for co-creating brand culture.

Hey, it’s Marc. On 51 Insights we’re publishing obsessively curated field notes and actionable insights to help thousands of Web3 leaders grow their business. Connect with me on LinkedIn. ✌️

👉 Want to get in front of 70k+ business leaders or accelerate your growth? Work with us here.

This is the definite case study of Nike’s Web3 strategy – and it is much more.

Nike would already be intriguing enough in its own right. At the same, Nike helps us to understand the sweeping changes at the intersection of culture, branding, communities and technology - changes that herald a new era for consumer brands.

So, why focus on Nike?

Nike has been a trailblazer among consumer brands that have started using Web3 tech to redefine their consumer relationships. “Nike has embedded itself into the fabric of Web3 culture before the competition has even taken off”, titled CoinDesk. And we know how so much in Web3 is about culture.

In April, Nike revealed its inaugural digital collection, named “OurForce 1” (OF1). This marks a new phase in its Web3 journey and a shift towards a wider consumer market. Described by Nike as a "tribute to our first 50 years, designed for the digital generation," the collection underlines the brand's continued evolution.

How did the leading Web3 consumer brand (just) do it? What can we learn from it? And what’s the big picture?

In this article, I’ll cover:

Understanding Nike’s culture, storytelling, and brand experience

Nike’s Web3 journey

Assessing Nike’s Web3 performance. For that, I’ll be using my Web3 community formula outlined here, among others.

The bottom line of Nike’s Web3 journey

The big picture (the 🥩 part of the discussion)

If you’re new to Web3 and the metaverse, I suggest starting here.

Ready? Let’s dive in!

Understanding Nike’s culture, Storytelling, and Brand Experience

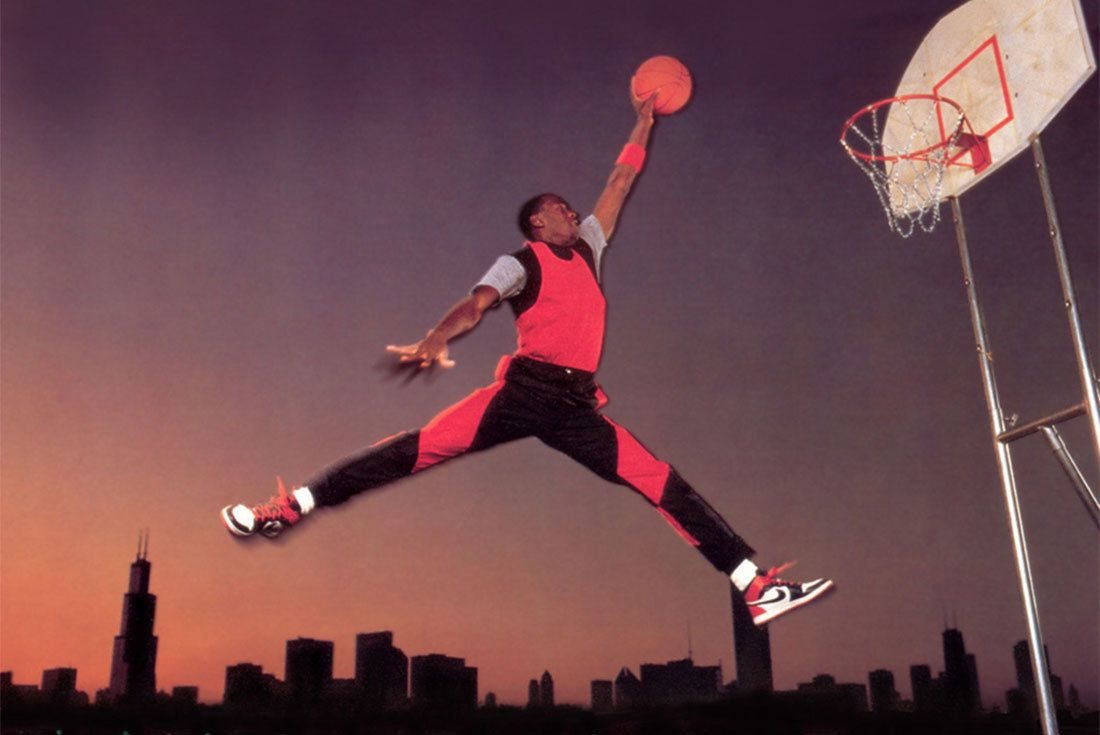

Nike is one of the most iconic brands in the world. It has achieved global recognition as a brand synonymous with performance, innovation, and style. With its timeless slogan "Just do it," Nike evokes a sense of aspiration and ambition, transcending the barriers of language, age, and culture. Nike succeeds in expanding its brand appeal to diverse audiences and subcultures with a perfect mix of impactful storytelling, cutting-edge innovation, and engaging brand experiences. It's an art that few have been able to replicate.

Creating and becoming part of culture has been a trend in branding spanning decades. Aleksija Vujicic from Multicoin Capital writes:

“As religion declined across the Western world, consumers began to seek meaning, identity, and belonging elsewhere – such as influencers, or more importantly, from brands. It was not enough for brands to merely be attached to a subculture—brands recognized the need to become culture.

Nike embodies this trend by integrating into everyday life, effectively becoming a part of culture itself.

A key factor in Nike's cultural impact lies in its strategic partnerships with influential individuals and brands, keeping brand at the forefront of cultural trends. From hip-hop collaborations with Drake, Wu-Tang, Jay-Z, Eminem, to partnerships in skateboarding with Paul Rodriguez, Stefan Janoski, and in e-sports with Jian Zihao, Nike consistently maintains cultural relevance.