Figure’s Wall Street debut isn’t just another crypto IPO.

Figure Technologies just proved that blockchain can actually fix broken parts of the financial system, and make money doing it. [RELEASE] At a $7.6B valuation and 18x revenue multiple, Figure now trades in line with Coinbase and Robinhood. That tells us two things:

Public markets are ready to treat blockchain rails as investable financial infrastructure, not speculative tech.

Tokenised credit markets are moving from pilot → scale, with Figure capturing 74% of tokenised private credit on-chain.

Why it matters: Figure’s $787M IPO is the first major proof that blockchain works best when it makes existing systems better, not when it tries to replace everything.

Let’s dive in.

👉 Get your ad spots now and reach 35k+ digital asset leaders

👉 Subscribe to our digital asset treasury newsletter

The State of RWAs

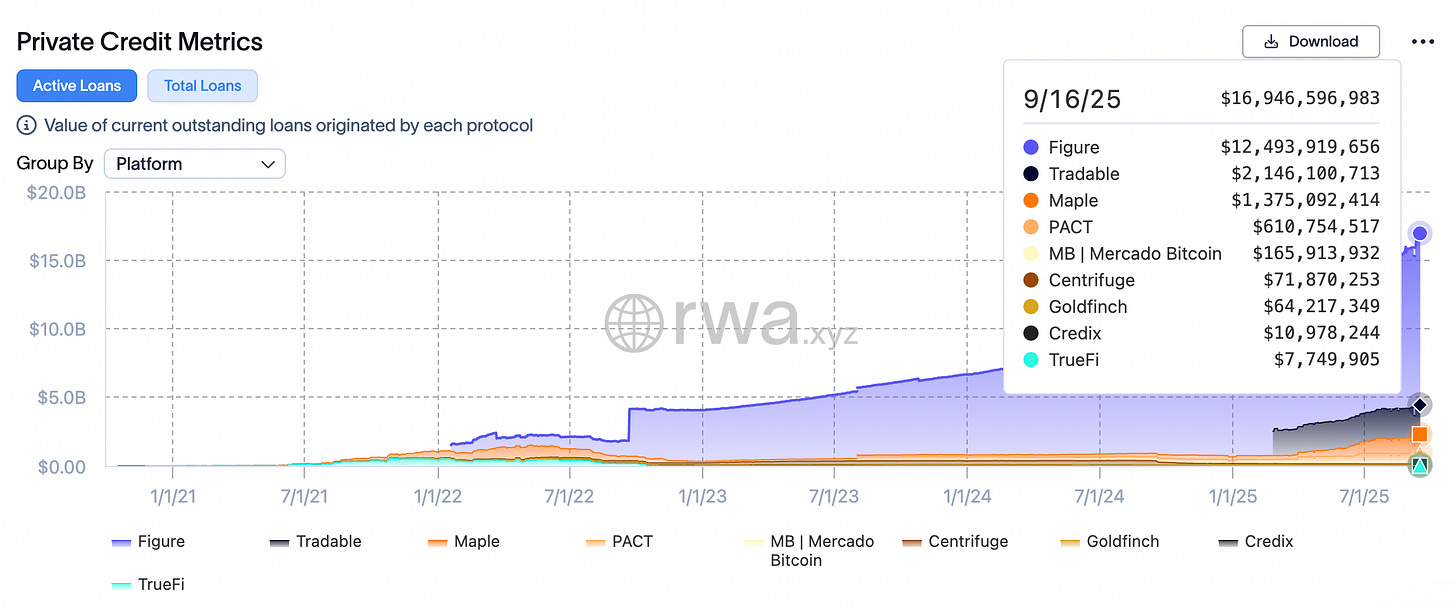

The current state of real-world asset tokenisation (RWAs) is dominated by Private Credit, which contributes to more than 50% of the total asset value of $30.24B.

The tokenised private credit has a total loan value of $16.98B, out of which 74% ($12.49B) of loans are being originated on Figure.

Most of Figure's activity is conducted on its own Provenance blockchain, designed for compliant asset tokenisation and financial contracts.

Case Study: Figure Technologies

IPO Highlights

Name: Figure Technology Solutions, Inc. (FIGR 0.00%↑)

IPO Date: September 11, 2025 (SEC S-1)

Valuation: $7.62B after first-day trading

Share Performance: IPO priced at $25/share, opened at $36, surged 44% on debut

Capital Raised: $787.5M via 31.5M shares (upsized IPO)

Revenue Multiple: 18x — identical to Coinbase/Robinhood, ~3x above SoFi

Timing: Biggest U.S. IPO week since 2021, fueled by strong equity markets

Business Fundamentals

Figure operates a blockchain-native capital marketplace that seamlessly connects and modernises three core components of financial activity:

loan origination

funding,

and secondary market trading.

Its business model is a vertically integrated flywheel, with revenue streams derived from loan origination fees, servicing fees, gains on loan sales, and technology usage fees from its partners.

Core Business: Blockchain-powered lending platform for home equity lines of credit (HELOCs)

Scale: Facilitated $6B in home equity lending in the 12 months ending June 30, 2025 (up 29% YoY)

Technology: Runs on Provenance blockchain, built to originate, verify, and process loans

Adoption:

10 of the top 20 mortgage companies use Figure’s tech

20+ large banks are already on Provenance

A central pillar of this model is "partner-branded lending," where other financial institutions, including banks and mortgage originators, use Figure's platform under their own brands. This business-to-business (B2B) approach is highly scalable and has allowed Figure to build a robust ecosystem of over 160 partners.

Zooming in: Home equity loans are a nightmare.

Traditional timeline: 42 days to get money

Involves 7+ parties for settlement

Mountains of paperwork (literally cardboard boxes in the 80s)

Costs lenders 85 basis points in unnecessary fees

What Figure did: Built their own blockchain (Provenance) and automated the entire process.

Here's where it gets interesting. Figure didn't just become a better lender; they became the infrastructure other lenders use.

The numbers:

168 partners now originate loans through Figure's system

77% of loan volume comes from partners, not direct lending

Partners save up to 1% by trading loans on Figure's blockchain marketplace

Not just that, unlike most blockchain companies, Figure makes actual profit:

2025 half-year numbers:

Revenue: $191M (up 22% YoY)

Profit: $29M

Loan volume: $3.2B (up 27% YoY)

Valuation

At 18x revenue, Figure now trades closer to Coinbase than SoFi, meaning public markets are pricing blockchain distribution rails as financial infrastructure. For investors, that multiple creates a valuation anchor for the next tokenisation IPOs (Centrifuge, Maple). For banks, it signals equity markets will reward integrated blockchain lending platforms over fintech wrappers.

What investors are betting on:

That Figure's loan business is just the beginning of a broader blockchain finance platform. Their approach is simple: to make the existing system work better.

Zooming out: Blockchain technology is not for disruption or reinventing the wheel. Figure focused on compliance and integration to make the system better and efficient with blockchain technology, and they also got validation.

SEC-approved yield-bearing stablecoin (YLDS)

More tokenised private credit than any competitor

After the 2024 election and regulatory clarity on crypto, the IPO timing worked perfectly for the company.

Dan Morehead (Pantera Capital): "It was really just the SEC that was making it very scary for entrepreneurs to build things in the US... I think the election last November is a massive unlock."

Devil’s advocate: Figure’s exchange trading volume is still tiny. If blockchain trading doesn't take off, Figure is just a mortgage tech company.