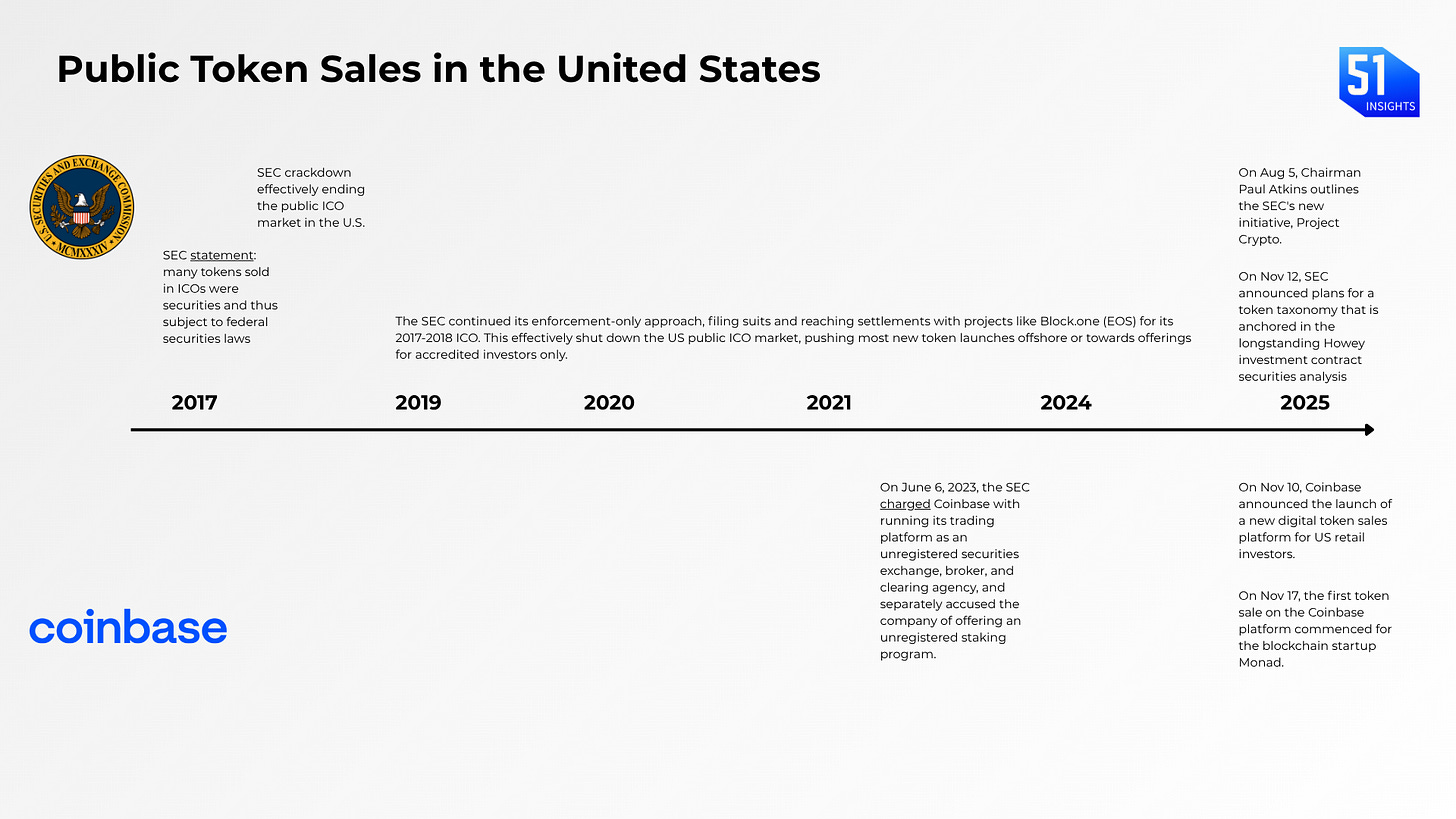

Crypto’s dirtiest secret is getting a rewrite and Coinbase is holding the pen. After five years of silence, U.S. token sales are back.

Coinbase just restarted the primary market with a structure built to favor real users, not insiders.

The pitch is simple: no more private rounds. No more dump-and-disappear launches. Just one token sale per month, accessible to everyone, on a platform that guarantees liquidity, compliance, and aligned incentives [ANNOUNCEMENT].

(👉PRO readers: PDF at the bottom)

What happened

Coinbase is launching an end-to-end token sales platform for global retail users (including the United States). The first sale will run from November 17 to 22. With that, Coinbase is redesigning how tokens are distributed, priced, and launched.

Key elements:

Global retail reach: Coinbase’s 100M+ user distribution.

Fair access: One token sale per month with pre-launch access for everyone, $100–$100k ticket sizes, paid in USDC, and zero fees for buyers.

Sale window mechanics: One-week request periods instead of FCFS scrambles.

Liquidity: Tokens move directly from sale → listing → deep order books.

Aligned incentives: Early dumpers automatically receive smaller allocations.

Regulatory compliance: Disclosures, lockups, and restrictions on insider sales.

The thesis: Projects struggle to reach actual users through launches. Retail buyers get boxed out or dumped on. Early insiders dominate supply. Market depth is thin. And demand is distorted by a handful of buyers who move early and sell fast. This is Coinbase’s attempt to re-onshore the token sale model, previously dominated by unregulated offshore exchanges and opaque venture capital structures known as Simple Agreements for Future Tokens (SAFTs).

Coinbase’s bet: A healthier token economy requires (1) broad distribution, (2) transparent rules, and (3) incentives that reward long-term participants instead of short-term flippers.

PRO readers: Join us live with Tony McLaughlin, CEO of Ubxy, on Dec 3rd, 11am EST. Save the date!

The first real test is the launch of Monad (MON), a high-performance Layer 1 aiming to raise $187.5M at a $2.5B valuation. How this sale performs: before, during, and after listing, will show whether a regulated, U.S.-accessible token sale can compete with the offshore models that have dominated since 2018.

Zooming in: For the Monad sale, the entity designated as the seller of the tokens is MF Services (BVI) Ltd., a subsidiary of the Monad Foundation, which is legally registered in the Cayman Islands. Utilising an offshore jurisdiction, such as the British Virgin Islands (BVI), to conduct the actual token sale is a standard practice for managing global regulatory exposure related to asset issuance.

Coinbase isn’t issuing or selling the tokens, it’s just providing the platform. This helps limit its legal risk, since it’s acting more like a regulated access point than a promoter of a potential unregistered security. Instead of taking a cut from users, Coinbase earns a percentage-based fee from the token issuer, based on how much they raise in USDC.

🙌 Work with us: We arm financial institutions and digital asset leaders with bespoke research, thought leadership to shape the most important conversations, scale trust, and win business.

Why it matters

Loyalty, trust and distribution in a package. For projects, this solves global distribution, liquidity, and trust. For users, it opens access to early-stage tokens in a way that’s transparent and fair. For the industry, it’s the clearest sign yet that crypto is maturing into a proper capital market with real underwriting, real disclosures, and real accountability.